|

Why UAE Free Zone

|

» UAE Company Formation - Why Free

Zone

|

|

Expanding and shifting

your business activity through UAE Free Zone Company set up

RAK Investment Authority (RAKIA) is a Government body formed in 2005 with

a mandate to promote industry, trade, investment, tourism and infrastructure

in the Emirate of Ras Al Khaimah in UAE. Located within 1 hour driving distance

from Dubai (85 kms) and 30 minutes drive from Sharjah (45 kms), the land

and infrastructure costs are competitive by as much 50-60% as compared to

any neighboring Emirate.

RAKIA acts as a one-stop shop for all investor needs. RAKCA services include

offering Free Zone business licenses , visas, industrial plots, warehouses,

labor accommodation, commercial space, building permits etc. RAKCA provides

all necessary infrastructure and approvals under one umbrella for all investors

including partnering them for their projects in UAE.

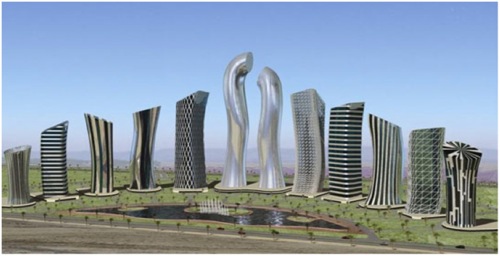

Financial City Ras Al Khaimah United Arab Emirates – Under Construction

Pro Business Environment – The UAE Advantage

To the prospective investor, the UAE presents an extremely favorable business

environment. Excellent infrastructural facilities coupled with professional

expertise and personalized services give the UAE the edge. Customer needs

are met in the shortest time frame. Enjoying the following facilities.

Fiscal Benefits

• 100% income and corporate tax exemptions.

• No Foreign exchange controls.

• 100% capital and profit repatriation.

• Strong appreciating and fully convertible currency.

• Low Inflation.

• Easy funding from International Banks.

Regulatory Benefits

• 100% ownership in Free Zones.

• No trade barriers or quotas.

• Easy Licensing Procedures

• Simple Import, Export Policies

• Liberal labor laws.

• No restrictions on hiring expatriates.

And also

• Issue of visit and residence visa.

• Open door policy.

• Single window clearance for permits and consents.

• Every investor gets personal attention.

• Cost and time savings.

• Good roads, drainage and sewage facility.

• Ready availability of power, water and gas at competitive prices.

• Good telecommunication facility and immediate phone and broadband

connection.

• Investor breaks ground within 3 months of signing lease contract

as against 12-18 months elsewhere.

• Excellent local and international banks for funding project finance.

• Proximity to entire gulf and global markets.

• Affordable hotels, sports and leisure facilities.

UAE has Double Taxation Avoidance Agreements (DTAA) with

a number of countries

Double taxation agreements prevent individuals and corporations from being

susceptible to paying tax on the same item during the same time period.

These agreements determine which of the two states concerned should levy

tax in a particular situation: Austria, Belarus, Belgium, Canada, China,

Czech Rep., Egypt, Finland, France, Germany, India, Indonesia, Italy, Lebanon,

Malaysia, Malta, Morocco, New Zealand, Pakistan, Poland, Romania, Singapore,

Sudan, Thailand, Tunisia, Turkey, Ukraine.

Main features of UAE Free Zone company

It needs to have physical offices in the UAE.

It may carry on business within the UAE.

It may obtain UAE residency Visa.

It can have non UAE resident as director or shareholder.

It can have UAE resident as director or shareholder.

It may own real estate in the UAE, with prior authorization from RAK Investment

Authority.

It may not do banking and insurance business without special license.

It may maintain bank accounts and deposits in the UAE.

It is not obliged to maintain its books and records.

It may hold shares in other UAE and worldwide companies.

It may own yachts registered in the UAE.

Middle East and the Gulf

Thanks to geographical proximity and cultural similarities, RAK Free Zone

is an attractive location for businesses from countries in the Gulf and

the Middle East. These countries already have strong business links with

the United Arab Emirates. RAK Free Zone is also likely to benefit from the

fact that some countries in the region suffer from political unrest and/or

asset protection issues.

Russia & CIS Countries

Confidentiality and financial privacy coupled with issues such as political

uncertainty, weak currencies, taxes, severe foreign exchange controls and

asset protection in Russia and CIS countries make RAK Free Zone a viable

option for businesses from these regions who seek an onshore location.

Europe, India & Other Countries

Companies in this region have a favorable image of the UAE as a business

centre. Add to that their interest in investing in the booming economies

and financial markets of the GCC and it is not hard to see why RAK Free

Zone is a perfect onshore location for these companies.

|

|

|

|